INTRODUCTION TO

ESI AND PF Registration

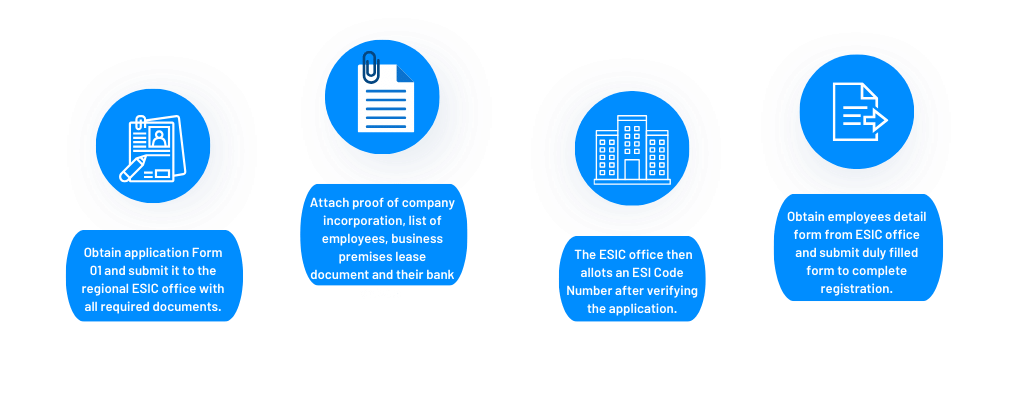

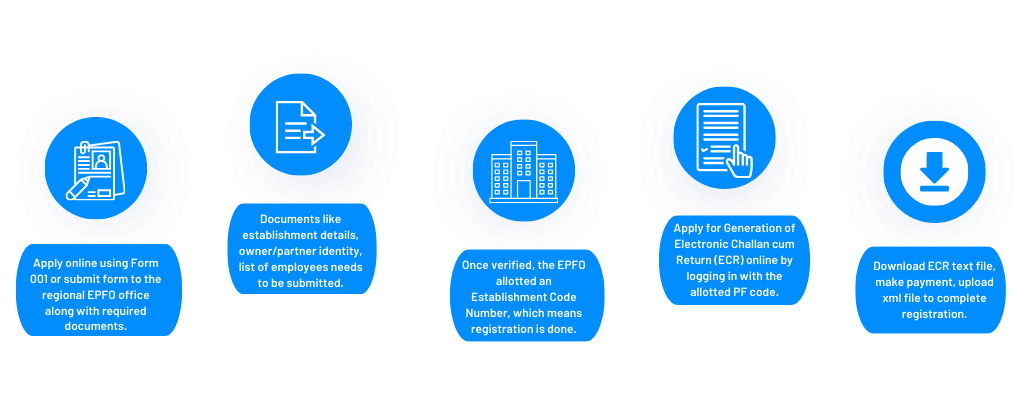

The Employees’ State Insurance (ESI) Act 1948 and Employees’ Provident Fund and Miscellaneous Provisions Act 1952 are social security legislations enacted by the Government of India. They aim to provide social protection to employees in the organized sector.

The ESI Act provides for medical, disability, dependent, and other benefits to insured employees and the PF Act assures financial security post retirement. All establishments having 10 or more employees and paying wages up to a specified limit need to be registered with designated regional ESI and PF offices.

Subsequently, all eligible employees need to be enrolled. Registration allows establishments and employees to avail scheme benefits. Timely contribution, proper maintenance of records, and periodic inspections ensure robust implementation.