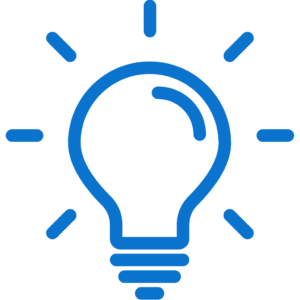

Partnership registration

India entry services

NKG Experts help our clients navigate through the tough, complex and often changing regulatory requirements in India. Having been behind thousands of registrations over years, Team NKG assists its clients in overcoming various challenges by systematically following a transparent , predictable and efficient regulatory strategy.