INTRODUCTION TO

Pan and Tan Registration

PAN and TAN are important tax registrations mandated by the Indian Income Tax Department for individuals and businesses to fulfill tax compliance.

Permanent Account Number (PAN) is a 10-digit alphanumeric identity allotted to taxpayers like individuals, companies, and other entities to track financial transactions, file tax returns, and ensure taxes are paid.

Tax Deduction and Collection Account Number (TAN) is a 10-digit code provided to employers, businesses and entities that deduct tax at source or collect tax on certain transactions. Having a PAN and TAN is critical for financial dealings, paying taxes on time, maintaining tax records properly and avoiding penal action.

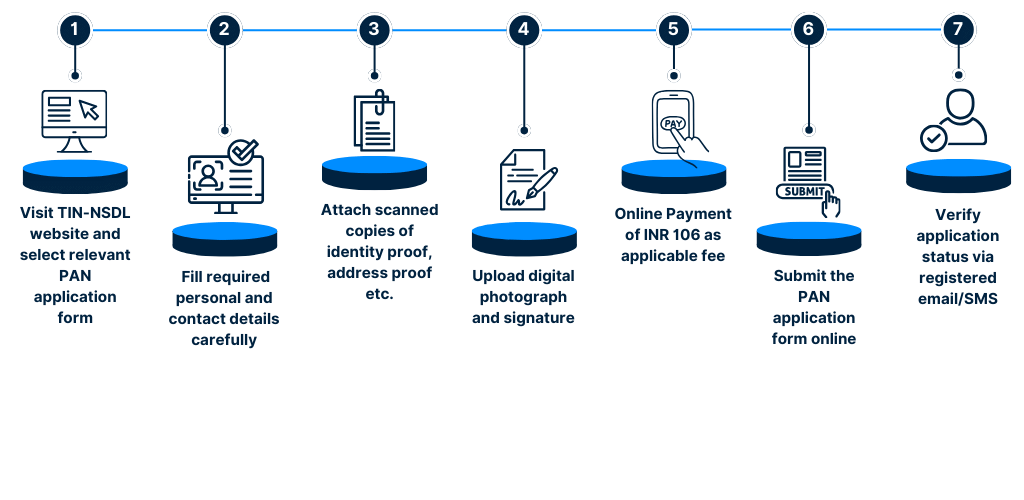

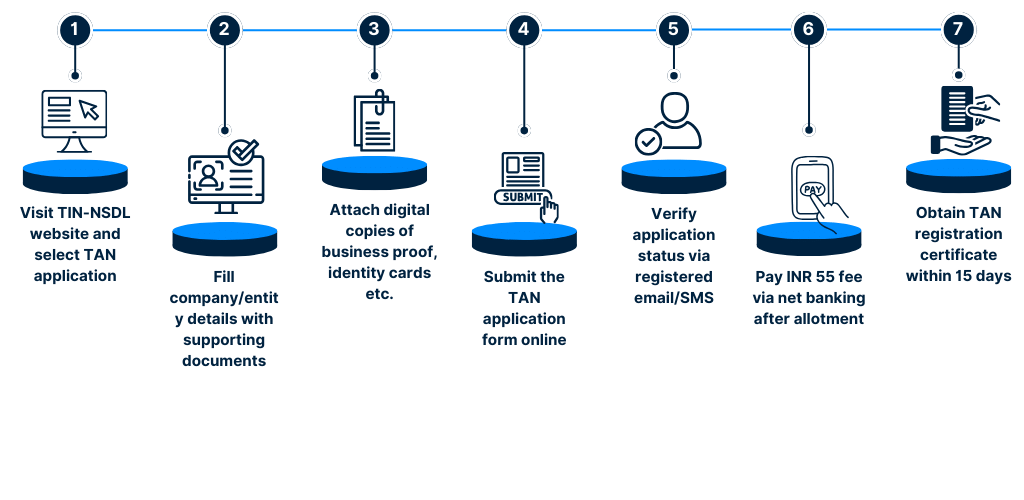

The application procedure for PAN and TAN has been eased by the Tax Department for hassle-free registrations through online portals with minimum documentation requirements. Obtaining a PAN and TAN has become essential for anyone looking to be part of India’s tax system and governance.